Maggie Powers Every Post on the Fast Track to Growth

She refuels daily with SEO & GEO insights to better serve.

Unlock More Content Ideas

Create an account or log in to explore exclusive blog topics, SEO strategies, and GEO-targeted content generated by AI CMO Maggie

[ Tailored for your brand's next growth leap. ]

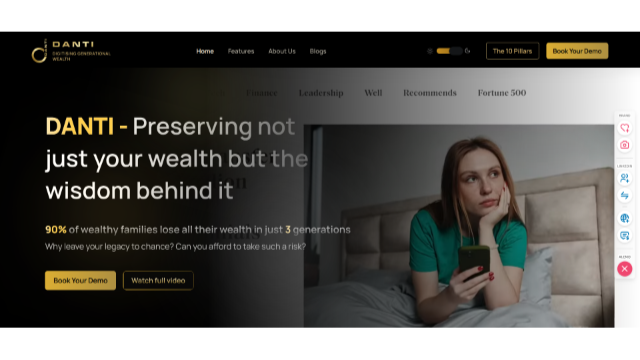

LegacyLink: Digital Solutions for Preserving Generational Wealth

LegacyLink: Digital Solutions for Preserving Generational Wealth

Created 12 Dec 2025

LegacyLink aims to revolutionize the way families manage and transfer wealth across generations by digitizing the processes involved in wealth management. Studies indicate that 90% of wealthy families lose their wealth by the third generation, primarily due to poor management, lack of planning, and communication failures. LegacyLink provides a comprehensive platform that organizes family wealth, facilitates transparent communication, educates members on financial literacy, and ultimately preserves not just financial assets but the wisdom behind managing those assets. The platform bridges the gap between traditional wealth management services and the digital conveniences expected by modern families. By utilizing innovative technology such as AI-driven forecasting and secure data management, LegacyLink positions itself as a leader in generational wealth preservation. The platform's attractiveness lies in its ability to consolidate wealth management functions while enhancing family engagement in wealth-related conversations. With opportunities to partner with financial institutions and wealth advisors, LegacyLink can impact not only individuals but also the wider financial ecosystem.

Industries

Maggie Studies the Tracks Before the Journey Begins.

She learns every detail of your business through deep market research.

Target Problem

A significant challenge facing wealthy families is the loss of financial assets over generations, with statistics indicating that 90% of wealthy families dissipate their wealth by the third generation. This is often due to a combination of poor financial literacy, lack of communication, and inadequate planning. Conventional wealth management practices tend to be cumbersome and often lack transparency, leading to misunderstandings among family members about the management of their collective assets. Additionally, many families are unprepared for the complex decisions involved in wealth transfer, further complicating the legacy they wish to leave. LegacyLink directly addresses these issues by providing intuitive digital tools that guide families through the intricacies of wealth management and legacy planning, ensuring that both their financial resources and the accompanying wisdom are preserved for future generations.

Target Regions

Target Audience

High Net-Worth Individuals (HNWIs)

Individuals or families with significant wealth who are looking to preserve their financial legacy and educate future generations.

Wealth Managers and Advisors

Financial professionals seeking to offer enhanced services that help clients manage and transfer their wealth efficiently.

Family Offices

Private wealth management advisory firms catering to affluent families. They require integrated solutions for investment management and legacy planning.

Educational Institutions

Organizations looking to incorporate wealth management and financial literacy programs into their curriculums or workshops for students.

Market Research

The global wealth management market is estimated to be valued at approximately $82 trillion in 2023, with a projected growth rate of 6.3% CAGR over the next five years. The surge in the number of high net-worth individuals (HNWIs) due to wealth generation through various sectors, including technology, finance, and real estate, drives this growth. Key factors influencing the market include the increasing uneven distribution of wealth, need for tax-efficient investing, and the growing complexity around transferring wealth to the next generation. Today's HNWIs are increasingly seeking digital solutions that provide transparency, personalization, and enhanced communication among family members. The market dynamic shows a significant shift towards technology-driven solutions, with firms like Danti leading in providing platforms that improve client experience while preserving generational wealth. The total addressable market (TAM) for digital wealth management platforms in North America alone is projected to reach around $30 billion by 2026, presenting immense opportunities for solutions focused on generational wealth preservation strategies. Moreover, evolving consumer behaviours emphasize the importance of financial literacy and communication in managing inherited wealth, anticipating demand for integrated educational services accompanying wealth management tools.

LegacyLink is not just a product; it's a movement towards enhancing the financial literacy of future generations while ensuring that their legacy is not lost. The platform is built on a robust technological foundation that includes AI and analytics for ensuring optimized asset management strategies. By encouraging family members to collaborate and communicate through the platform, LegacyLink fosters not only financial education but also strengthens familial relationships in the process. Additionally, partnerships with educational institutions will allow the project to tap into younger audiences, grooming them for responsible wealth management from an early age. As wealth continues to concentrate among the few, the need for effective generational wealth management solutions is poised to grow. With the increasing trend of financial technology adoption among families, LegacyLink is well-positioned to capture a significant market share in an industry ripe for digital transformation.

Maggie Maps Your Rivals Before Full Steam Ahead.

She benchmarks your brand against competitors to plot a smarter route.

Products & Services

Wealth Organizer

A digital tool that consolidates all financial assets, liabilities, and investment portfolios into one easy-to-use interface, providing a complete overview of family wealth.

Legacy Planning Toolkit

Tools and resources that help families create estate plans, wills, and trusts. This toolkit ensures that each family member understands their role in preserving wealth.

Family Communication Hub

A secure platform where family members can discuss financial matters, share insights, and make collective decisions, promoting transparency and collaboration in wealth management.

Educational Resources

Access to a library of materials ranging from financial literacy courses to investing seminars aimed at empowering younger generations to manage and grow their inherited wealth.

Unique Selling Points

SWOT Analysis

Strength

Innovative technology that simplifies wealth management for families, combining educational resources with comprehensive planning tools.

Weakness

Dependence on user engagement; the platform may require significant effort to build a user base initially.

Opportunity

Growing awareness among affluent families of the need to preserve wealth and educate heirs creates a ripe market for LegacyLink's services.

Threat

Competition from established wealth management firms and new fintech startups that may provide similar features.

Market Competitors

Wealthfront

Wealthfront

An automated investment service that provides personalized financial planning tools.

Visit Site Betterment

Betterment

A leading digital investment platform that offers personalized advice to individuals.

Visit Site Personal Capital

Personal Capital

Offers financial advisory services along with wealth tracking tools for individuals.

Visit Site Schwab Intelligent Portfolios

Schwab Intelligent Portfolios

Automated portfolio management solution from Charles Schwab with integrated wealth management features.

Visit Site Goldman Sachs Private Wealth Management

Goldman Sachs Private Wealth Management

Traditional wealth management services focused on high net-worth individuals and families.

Visit Site Merrill Edge

Merrill Edge

Investment advisory service of Bank of America with tools designed for financial professionals.

Visit Site Wealthsimple

Wealthsimple

A fintech company providing a range of investment services with an emphasis on simplicity and user experience.

Visit Site Kayne Anderson Capital Advisors

Kayne Anderson Capital Advisors

Offers specialized wealth management services aimed at individuals and families.

Visit Site Facet Wealth

Facet Wealth

Provides personalized financial planning services catering to diverse client needs.

Visit Site True Potential

True Potential

A digital wealth management platform that allows clients to manage their investments efficiently.

Visit SiteLaunch Effortless Blogging with Maggie

No more blank pages. Maggie runs your blog with vibe-rich, SEO-tuned, GEO-smart content — built to be loved by search engines and surfaced by AI.

Free Tools

AI Ideas BrainstormingAI Startup Trend AnalysisAI Project Management......

AI Co-Founders

RoadmapAll rights reserved by AI Marketing OS Ltd. Designed & Developed by TOPY.AI .