Maggie Powers Every Post on the Fast Track to Growth

She refuels daily with SEO & GEO insights to better serve.

Unlock More Content Ideas

Create an account or log in to explore exclusive blog topics, SEO strategies, and GEO-targeted content generated by AI CMO Maggie

[ Tailored for your brand's next growth leap. ]

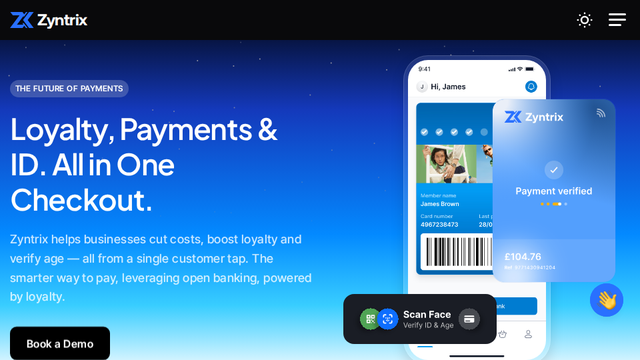

Zyntrix: Next-Generation Retail Payment Solutions

Zyntrix: Next-Generation Retail Payment Solutions

Created 13 Nov 2025

Zyntrix is poised to revolutionize the retail payments landscape by integrating open banking, loyalty programs, and digital identity verification into a single, seamless checkout experience. Designed to cut costs for businesses, boost customer loyalty, and simplify compliance processes, Zyntrix enables users to make payments with just a tap, eliminating the need for physical cards and minimizing wait times through efficient age verification. The implementation of Account-to-Account (A2A) payments reduces merchant fees by up to 70%, while instant loyalty rewards enhance customer engagement and spending. As consumer habits evolve towards faster and more secure payment methods, Zyntrix is well-positioned to meet these demands by offering a smarter, compliant, and engaging payment solution that benefits both merchants and customers alike.

Industries

Maggie Studies the Tracks Before the Journey Begins.

She learns every detail of your business through deep market research.

Target Problem

The retail industry faces significant challenges associated with traditional payment processing systems. High transaction fees affect profit margins, while lengthy checkout experiences hinder customer satisfaction. Additionally, ensuring compliance with age-restricted purchases can be cumbersome and lead to customer frustration. Zyntrix addresses these issues by offering an integrated solution that lowers costs through open banking, speeds up the transaction process, and simplifies compliance through automatic age verification. By resolving these key pain points, Zyntrix enhances the overall shopping experience for consumers and operational efficiency for retailers.

Target Regions

Target Audience

Retail Businesses

Businesses looking to enhance payment efficiency while reducing costs associated with traditional payment processing.

Regular Consumers

Tech-savvy consumers seeking a quick and rewarding payment experience without the hassle of cards or waiting for authorizations.

Regulatory Compliance Managers

Professionals within retail operations focused on ensuring compliance with age verification laws efficiently.

Market Research

The retail payments market is a dynamic and rapidly evolving sector, estimated to reach a valuation of approximately USD 2 trillion by 2024, growing at a compound annual growth rate (CAGR) of around 10%. This growth can be attributed to the swift adoption of digital payment solutions, the rise of e-commerce, and consumer demand for faster, more secure transactions. Key drivers include advancements in technology, increased internet penetration, and shifting consumer behaviors towards convenience. In particular, the European market shows a robust adoption of open banking solutions following regulations like PSD2. The seamless integration of loyalty programs also propels market dynamics, with businesses recognizing the value of enhancing customer engagement while optimizing costs. The total addressable market for Zyntrix is substantial as it targets both the B2B segment (retailers and operators) and B2C consumers, bridging significant gaps in current payment processing methods, particularly in addressing compliance as well as improving customer relations and retention.

Zyntrix's approach to unifying payments, loyalty, and digital identity is revolutionary, especially in a market that continually seeks efficiency and compliance. The technology landscape is evolving with the rise of open banking regulations, which allow for improved payment processing while ensuring customer data security. This aligns with global trends of businesses aiming to streamline operations while simultaneously enhancing the customer journey. Zyntrix provides a foundation for merchants not just to react to changing consumer expectations but to proactively shape their payment strategies to drive engagement and retention. Collaborations with banks and financial institutions could enhance the platform’s credibility and reach, opening doors to wider adoption. Moreover, bespoke solutions tailored to specific industries—whether retail, food service, or e-commerce—will make the platform even more appealing and effective. With the expected surge in digital payments and loyalty programs, Zyntrix is positioned to lead the charge in reshaping how customers interact with brands at the point of sale, demonstrating a core understanding of contemporary consumer needs. Continuous innovation, engaging marketing strategies, and sustained technical support will be pivotal to its roadmap for growth and success in the evolving fintech arena.

Maggie Maps Your Rivals Before Full Steam Ahead.

She benchmarks your brand against competitors to plot a smarter route.

Products & Services

Unified Payment Portal

A comprehensive payment solution that integrates open banking for direct A2A payments, providing cost-saving benefits and speed for merchants and customers.

Loyalty and Rewards Program

A built-in feature that instantly rewards customers at the point of sale, encouraging repeat transactions and increasing overall spend.

Digital Identity Verification

Facial recognition and tokenized ID checks that streamline age verification processes and comply with GDPR regulations.

Unique Selling Points

SWOT Analysis

Strength

Integrates multiple functionalities (payments, loyalty, ID verification) into one platform.

Weakness

Dependency on technology adoption among retail businesses.

Opportunity

Growing trend of digital payment solutions and emphasis on customer experience support market entry.

Threat

Intense competition from established payment solutions providers in the market.

Market Competitors

Square

Square

Offers a comprehensive suite of business tools including payment processing, point of sale, and financial services.

Visit Site PayPal

PayPal

A leading online payment system that supports online money transfers and serves as an electronic alternative to traditional paper methods.

Visit Site Stripe

Stripe

An integrated suite of payment APIs for e-commerce businesses, enabling easy payment processing.

Visit Site Adyen

Adyen

Provides a payment platform that enables businesses to accept payments through numerous channels and currencies.

Visit Site Shopify Payments

Shopify Payments

A fully integrated payment solution for merchants using the Shopify e-commerce platform.

Visit Site Klarna

Klarna

A leading global payment provider that offers a range of payment options, particularly in e-commerce.

Visit Site Worldpay

Worldpay

Offers payment processing solutions with a focus on integrated omni-channel experiences.

Visit Site Alipay

Alipay

The leading payment platform in China, providing a vast range of financial services.

Visit Site Revolut

Revolut

Digital banking app offering international payments, budgeting tools, and cryptocurrency integration.

Visit Site Venmo

Venmo

Mobile payment service allowing users to transfer money to others and make purchases.

Visit SiteLaunch Effortless Blogging with Maggie

No more blank pages. Maggie runs your blog with vibe-rich, SEO-tuned, GEO-smart content — built to be loved by search engines and surfaced by AI.

Free Tools

AI Ideas BrainstormingAI Startup Trend AnalysisAI Project Management......

AI Co-Founders

RoadmapAll rights reserved by AI Marketing OS Ltd. Designed & Developed by TOPY.AI .